type of allowance for employees in malaysia

In Malaysia the employee benefits are outlined in the Employment Act 1955. Meal allowance is paid according to the position duties or place where the employment is performed by the employee.

Contoh Payslip Gaji Swasta You Can Slip Wecanfixhealthcare Info Office Word Word Template Resume Design Free

19200 per annum under section 10 14 ii of income tax act.

. Exercises an employment in Malaysia. Normal working day 15 Basic pay 26 days X 15 X hour of works. It is a mandatory requirement.

Dearness Allowance Dearness Allowance DA is a cost of living adjustment allowance paid toDA is a cost of living adjustment. This includes a guidelines list that all employees are required to abide by. This allowance does not fall in the category of perquisite and is partially taxable.

Some benefits are made mandatory by the Employment Act 1955 such as annual leave sick days working hours etc. Employee benefits are compensations or rewards that reimburse your employees on top of their base salary. 2022 MALAYSIA BENEFITS SUMMARY.

KUALA LUMPUR Aug 1 The government. Such allowances are mostly paid to the government employees. The allowances which are paid to the employees by employers forming a part of the salary but are fully exempted from taxes are called non taxable allowances.

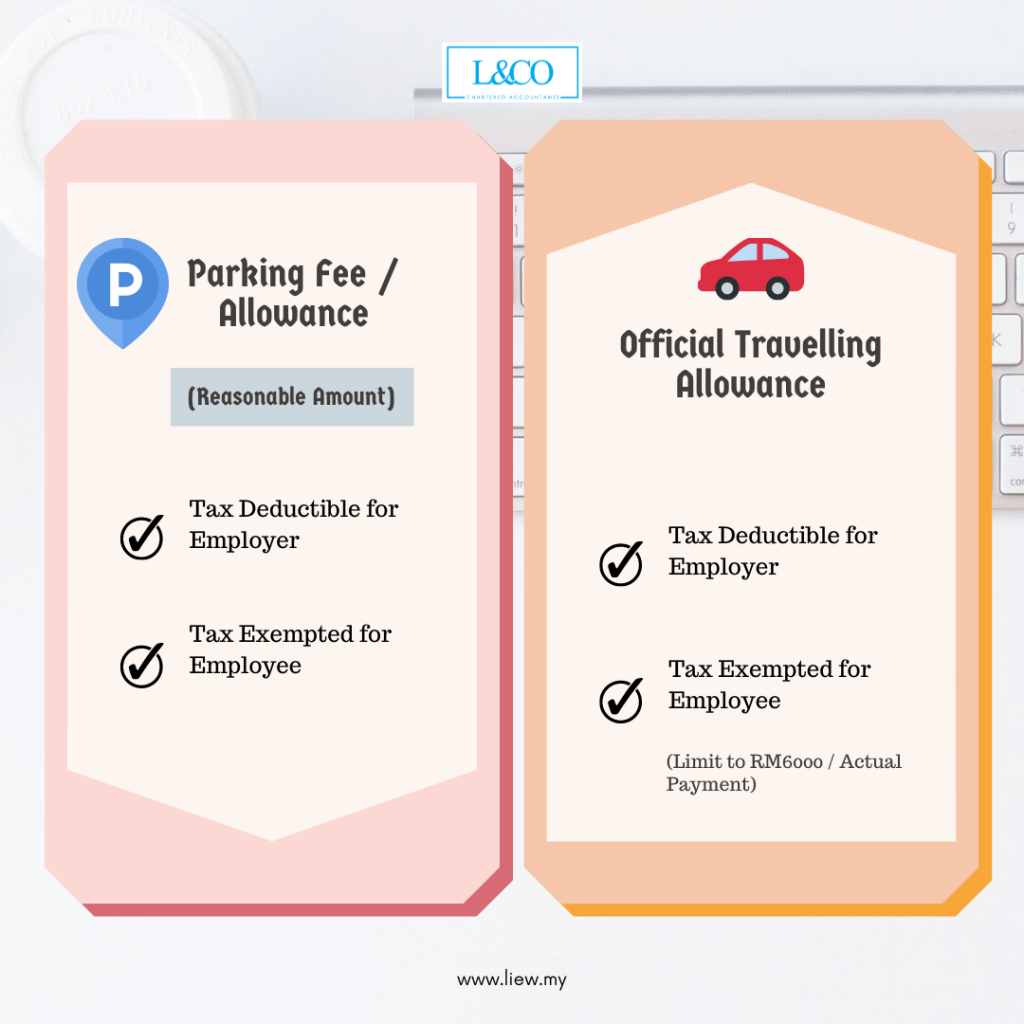

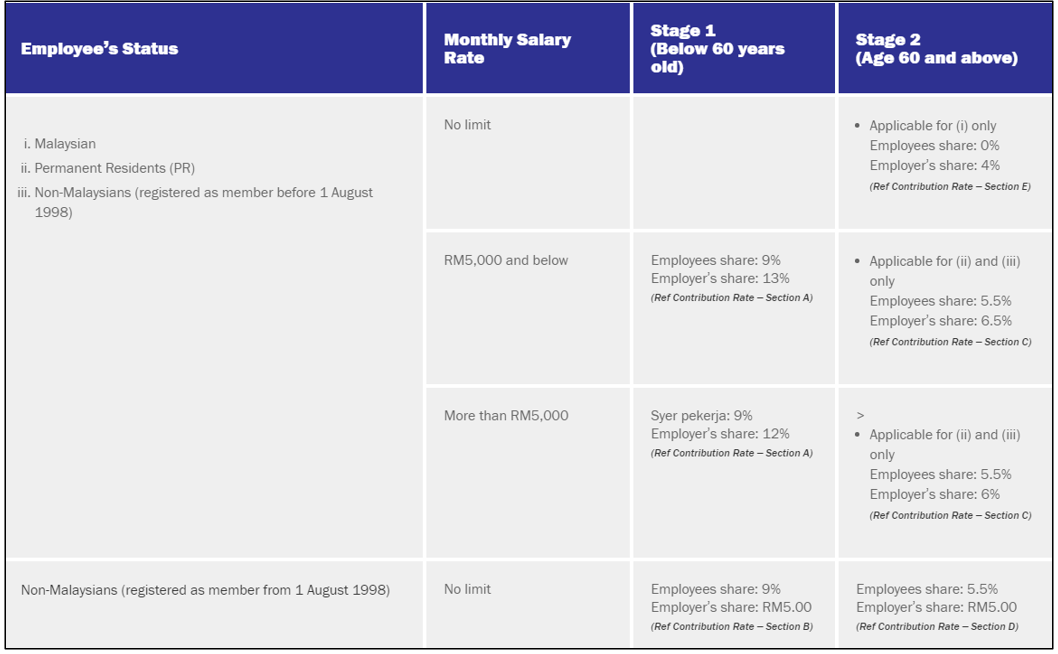

Travelling allowance petrol allowance toll rate up to RM6000 annually. Salary bonus allowances perquisites. Employees are eligible for most benefits programs on the first day of employment.

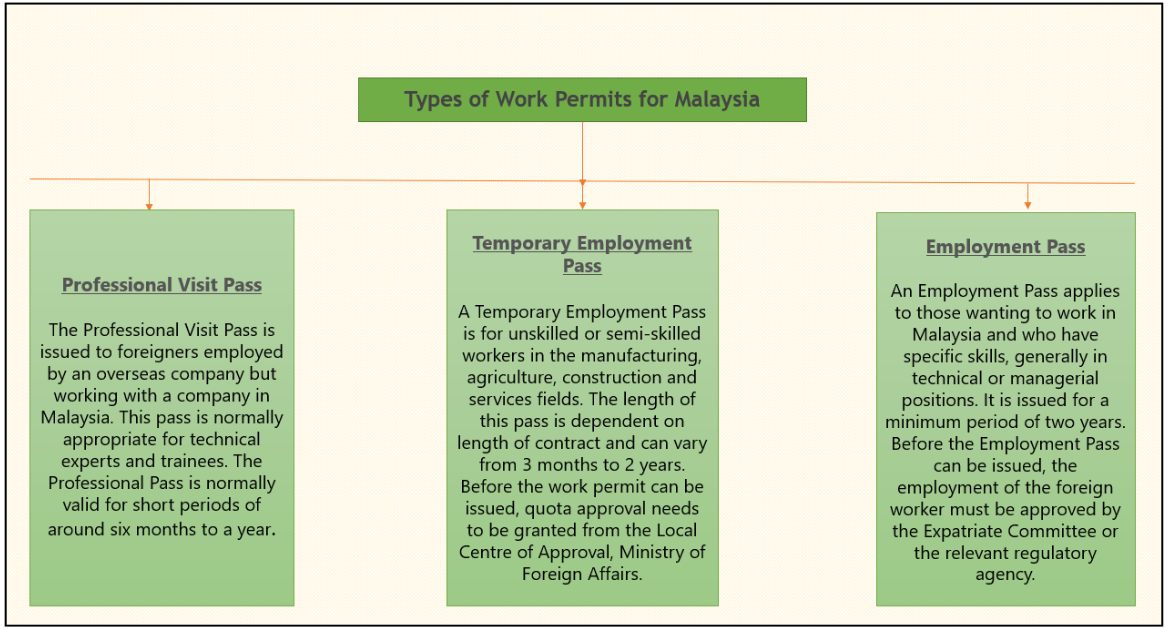

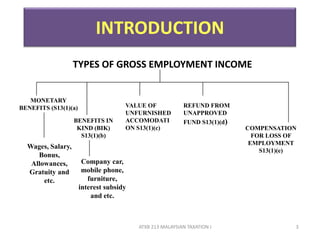

Type of employment income. Employment income is regarded as derived from Malaysia and subject to Malaysian tax where the employee. A special allowance is paid to an employee for the performance of a duty mentioned under section 14 i.

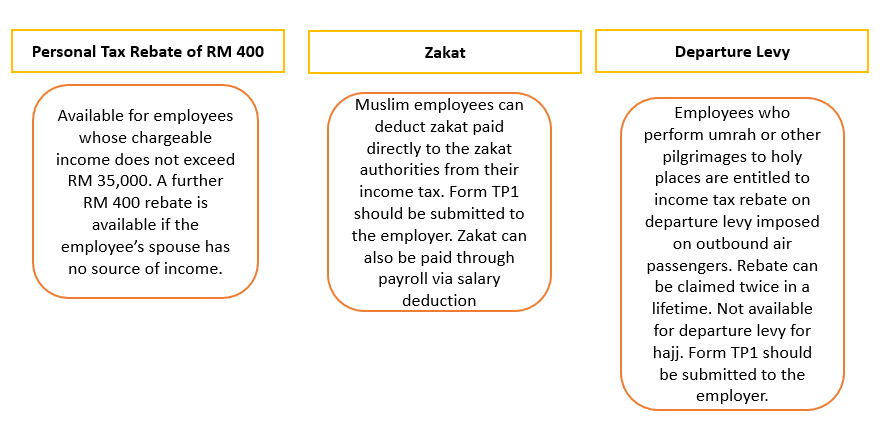

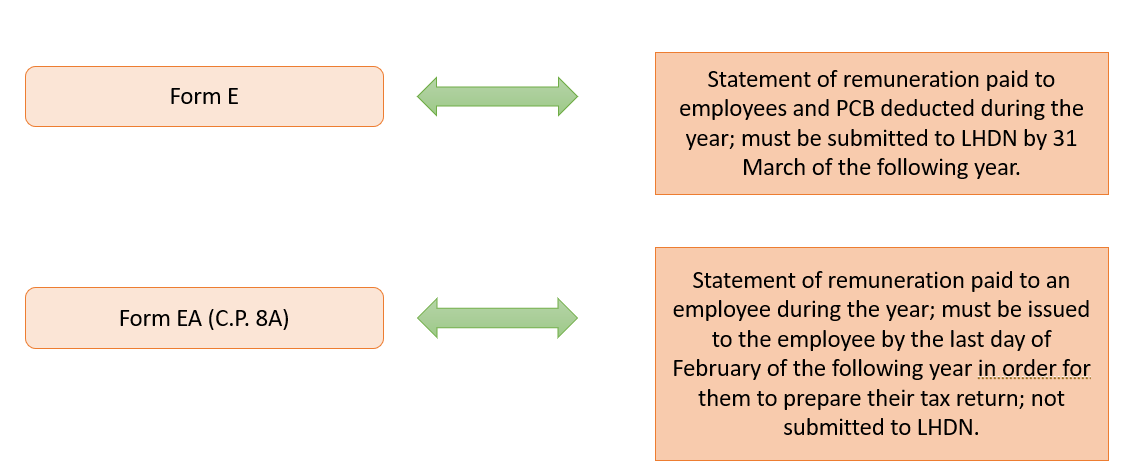

How OT hours are calculated based on Seksyen 60 3 Seksyen 60 1 Employment Act 1955. However depending on the type of allowance some LHDN tax deductions apply and you can meet the expectations of senior management and employees. I would categorise employee benefits in Malaysia into two types.

The lists of non taxable allowances are as follows-. Is Allowance Taxable in Malaysia. Child care allowance of up to RM2400 annually.

Non Taxable Allowances. Mandatory employee benefits bare minimum and AMAZING. Types of Allowances Types of Allowances 1Fully exempted allowances1Fully exempted allowances.

However there are exemptions. I get travel and phone allowance housing subsidy medical and dental and travel insurance and because my boyfriends only day off is Monday they were happy to let me take. Any other benefits are considered optional such as insurance retirement plan options training and many more.

Employee benefits are defined as the compensation non-wage that an employee is entitled to when working for an organisation. Working on Off-day 20 Basic pay 26 days X 20 X hour of works. Basic pay 26 days X 30 X hour of works.

This time is allowed for physical needs of the worker. The four types of allowances for retrenched workers are job search allowance early re-employment allowance reduced income allowance training allowance and training fee. Just like Benefits-in-Kind Perquisites are taxable from employment income.

Conveyance allowance above Rs. Working on Public Holiday. Certain allowances perquisites are exempted from tax.

Subsidies on interest for housing education car loans. The Definition of Employee Benefits. A worker does not work continuously like a machine and hence personal allowance is provided to him in order to satisfy his personal requirements like.

Total amount paid by employer. Types of Employee Benefits in Malaysia. Employees shall be granted 13 vacation days on a prorated basis for less than 2 years.

Follow us on Instagram subscribe to our Telegram channel and browser alerts for the latest news you need to know.

How To Write An Annual Leave Letter Download This Perfect Annual Leave Letter Template Now Lettering Letter Sample Annual Leave

Payslip Template Format In Excel And Word Microsoft Excel Excel Templates Word Template

Everything You Need To Know About Running Payroll In Malaysia

10 Payslip Template Word Excel Pdf Templates Payroll Payroll Template Excel Templates

Types Of Employee Benefits In Malaysia That Attract And Retain Talents Mednefits

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

Everything You Need To Know About Running Payroll In Malaysia

Everything You Need To Know About Running Payroll In Malaysia

Employee Benefits Definition With 8 Types And Examples

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

Everything You Need To Know About Running Payroll In Malaysia

Employee Benefits That Are Tax Deductible Employers Tax Exempted Employees L Co

Comments

Post a Comment